These Candidates Want to Eliminate Your Student Loan Debt

October 31, 2018Natalia Abrams graduated from UCLA in 2009, near the height of the Great Recession. That year, her state's public university system moved to raise tuition by about 30 percent, and she was shocked to see friends begin dropping out in the second semester of their senior years. The 20-something got involved with protests over the hike, which set her on the path to becoming executive director of Student Debt Crisis (SDC), where she's been advocating for an overhaul of America's deeply fucked student-loan system for the past six years.

If recent poll numbers from Harvard are accurate, young Americans are set to turn out for the 2018 midterms in record numbers. A survey of about 2,000 people between 18 and 29 conducted by the university’s Institute of Politics (IOP), found that 40 percent definitely planned to vote. Obviously saying "yes" on a survey takes less effort than waiting in a line on election day or wrangling with the US Post Office (which as a recent piece by New York Magazine illustrated, young people seem to have a ton of trouble with). But still, those numbers are high. If even 22 percent of eligible voters in that age cohort bothered to cast a ballot, it would be the highest turnout in more than three decades.

In an interview, Abrams argued that today's young people are going through a similar realization to the one she had a decade ago—that the higher education system is rigged against them. In fact, she said that higher education was among the biggest issues for millennial voters like her—and that we're at a unique point in history, with 10 percent of members of Congress actually grappling with debt of their own.

"I remember five or six years ago when this started to become a much bigger issue, we would hear things like, 'I got a part-time job job to pay for college,''" she told me. "That's no longer the case."

It may not shock you to learn that Donald Trump is not part of the solution here. On the campaign trail, he gave lip service to the idea of simplifying the byzantine world of student loan debt repayment plans, but when it came time to make actual budget proposals in May 2017, it became clear the president's plan was akin to "rearranging the deck chairs on the Titanic before it sinks," as one expert told me at the time. And in September, it was revealed that of the almost 30,000 people who applied to have their debt wiped after making on-time payments for a decade and devoting their early careers to helping others, only 96 people had received what was promised under President George W. Bush. That's not a typo—the program worked for less than 1 percent of those relying on it.

But as Abrams's activism shows, young people and recent college grads don't have to sit on their hands. In fact, according to money lender Laurel Road—which had market research firm Centiment poll 1,000 millennials who just graduated from or were currently enrolled in college—83 percent said the cost of college or the issue of student loan debt would influence how they voted in November.

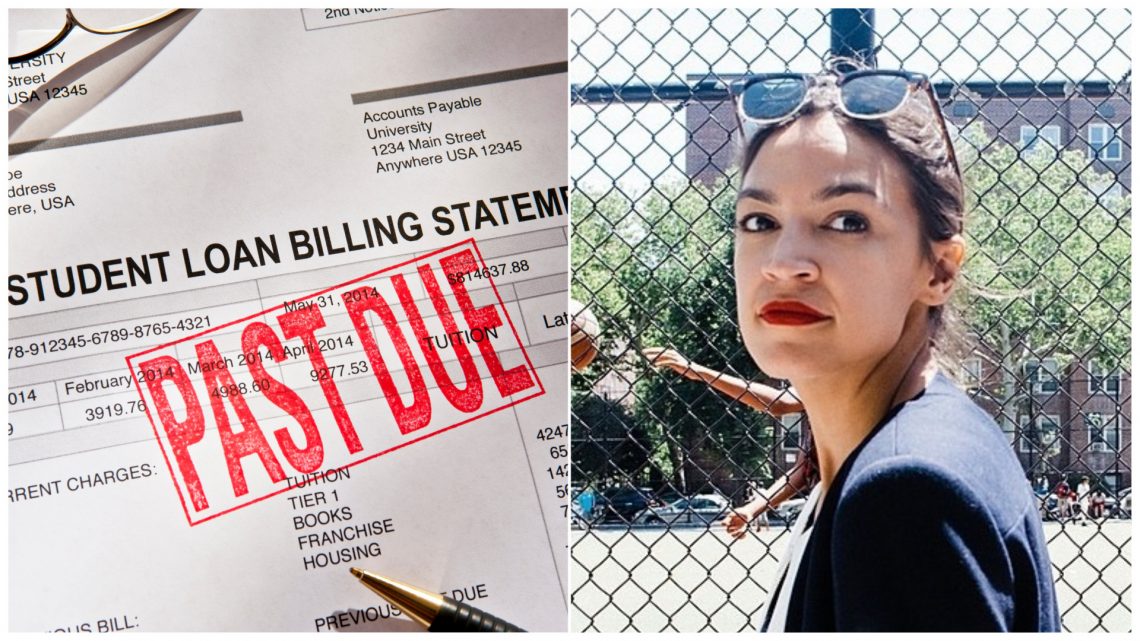

Women are likely to be on the forefront of this, as a record-breaking number of them are running for office, and they also bear nearly two-thirds of the $1.5 trillion in outstanding student loan debt. The gender component of this generational disaster has been visible on the campaign trail. For instance, there's Stacey Abrams, who's running for governor of Georgia and has been vocal about the fact that student loan-debt does not equally affect everyone. Alexandria Ocasio-Cortez, a progressive candidate running for congresswoman in the Bronx who also has outstanding loans, supports free college and cancelling student debt.

There are also a lot of public officials running for office or re-election with a track record of taking on some of the issue's biggest villains. Take California attorney general Xavier Becerra, who's suing servicer Navient for allegedly systematically providing borrowers with incorrect information, or for keeping them in the dark entirely about what how to get above water. Or Richard Cordray, who served as the first director of the since-gutted Consumer Financial Protection Bureau (CFPB) and did a lot of work on behalf of borrowers; he's now running in a tight race for governor of Ohio.

Then there's Eric Swalwell, the California congressman who proposed legislation last year that would dish out loan forgiveness to public servants in two-year increments. Although that bill never made it out of committee, its very existence suggested there were pols out there looking for creative suggestions to a looming catastrophe. Finally, Jared Polis, the Democratic congressman running for governor in Colorado, has introduced a bill to wipe out all student debt in the country, period.

Meanwhile, it's hard to imagine young voters being anything but repelled by attack ads like those run by Devin Nunez that claimed his Democratic opponent for a California house seat, the prosecutor Andrew Janz, was fiscally irresponsible and basically a loser because he racked up hundreds of thousands of dollars in student-loan debt. In fact, Democrat Abby Finkenaur, who's running to unseat a 63-year-old millionaire in Iowa, has cited her working-class background and student loan debt as among her qualifications for the gig.

For her part, Abrams—the activist, not the candidate—wanted young voters to realize there were in fact people on the ballot who had their backs. It wasn't clear if that message was getting through: More than 55 percent of millennials surveyed on behalf of Laurel Road were unaware of their state and local candidates' stances on the issue, and other polls have suggested millennials cared more about social issues than education. And with Trump riling up right-wing rage at immigrants in the final stretch of the campaign, Abrams was left to hope young people didn't lose focus on the debt problem given all the violence and hate in the news.

After all, student-loan debt isn't just a financial thing.

"For some borrowers, this has become a life or death issue," she told me. "We have an increase in suicide talk. It's very hard for people when they feel there's no light at the end of the tunnel."

If you or someone you know is having thoughts of suicide, contact the Suicide Prevention Lifeline.

Follow Allie Conti on Twitter.